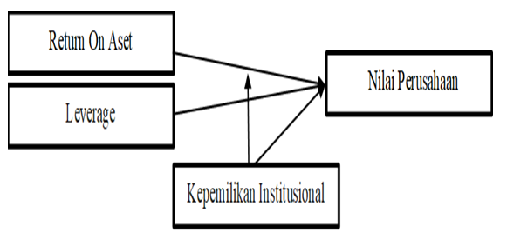

Pengaruh Return on Asset dan Leverage Terhadap Nilai Perusahaan Dengan Kepemilikan Institusional Sebagai Variable Pemoderasi

Abstract

The purpose of this study was to determine the effect of Return on Assets and Leverage on firm value with Institutional Ownership as moderating. Secondary data was collected as a sample from companies listed in the Consumer Goods Sub-Sector list listed on the Indonesia Stock Exchange for 2015 – 2019. Sampling in this study used a purposive sampling method with the following criteria: (1) listed on the Indonesia Stock Exchange 2015 - 2019. (2) Publish audited financial statements for the 2015-2019 period in Rupiah. (3) always has an advantage. The proposed research TKT falls into the third category, a proof-of-concept of functions and important characteristics analytically and experimentally. The results show that Return on Assets and Leverage have a significant effect on Firm Value; Institutional ownership does not affect the value of the company, and Institutional ownership is not able to moderate Profitability and leverage in influencing the firm value